2018 has been an exciting year for mirrorless camera fans, but m43 seems to be hurting from the competition. The release of cameras like the Fujifilm X-T2, Sony a7III, and a7RIII have put the squeeze on smaller sensor cameras and it might get worse if the rumored price reductions come to fruition with Nikon and Canon entering the mirrorless market. 2019 might be a make or break year for Olympus so let’s hope they release something exciting before the X-T3 and Nikon/Canon mirrorless cameras are released so m43 remains strong.

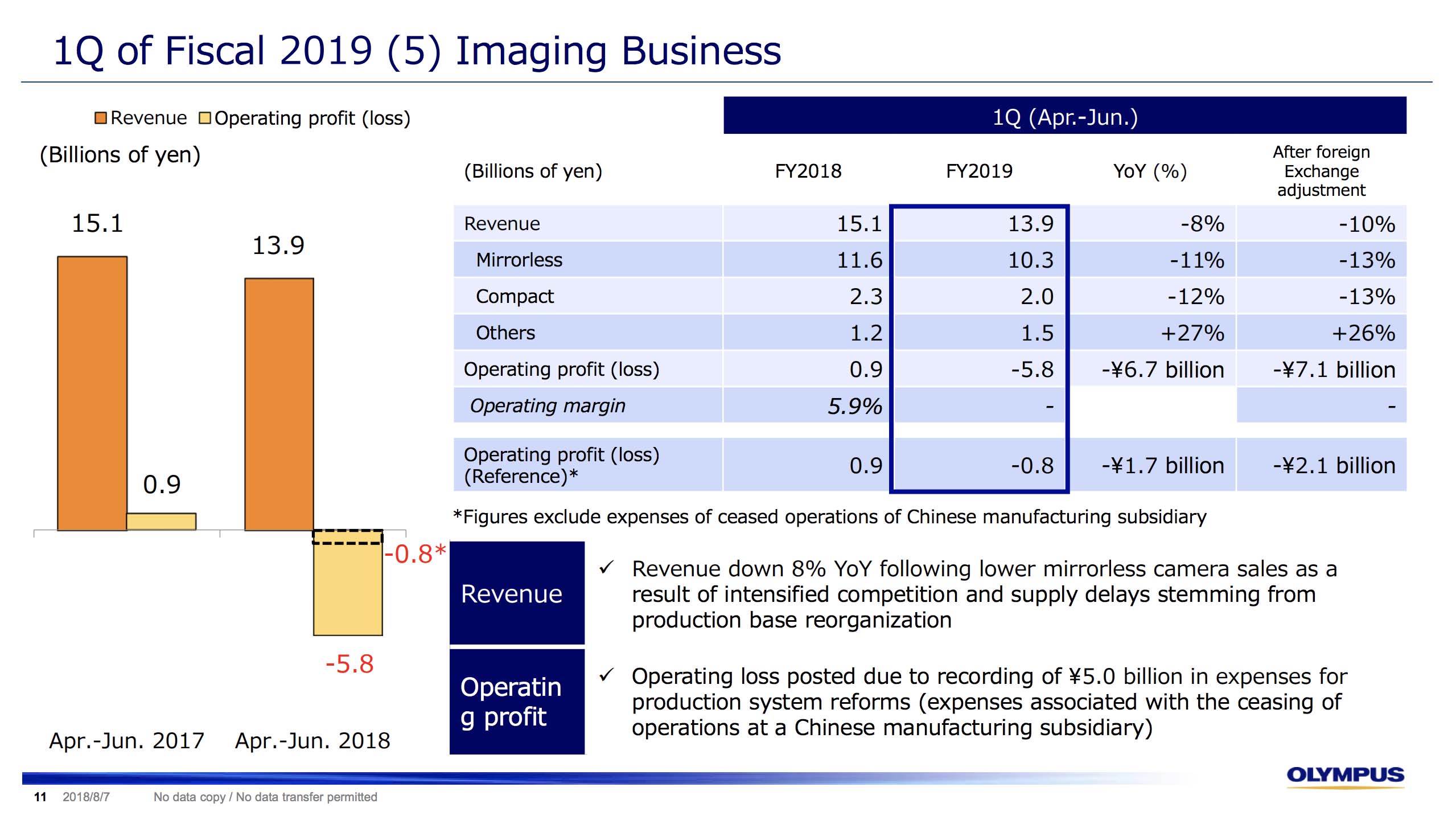

Consolidated revenue in the Imaging Business amounted to ¥13,891 million (down 8.2% year on year), while operating loss amounted to ¥5,785 million (compared with an operating profit of ¥886 million in the same period of the previous fiscal year).

The Imaging Business’s revenue declined due partly to the impact of constraints on supplies of certain products in conjunction with restructuring of manufacturing locations.

As a result of a decrease in revenues and the recording of costs associated with the restructuring of manufacturing locations, operating loss was recognized in the Imaging Business.

via Olympus